Ng Stock Price Today What Do Analysts Say

MindTree Ltd.

Insights

View All

-

In the last 14 years, only 1.87 % trading sessions saw intraday declines higher than 5 % .

-

20 day moving crossover appeared yesterday. Average price decline of -2.6% within 7 days of this signal in last 5 years.

-

14 day moving crossover appeared yesterday. Average price decline of -2.45% within 7 days of this signal in last 5 years.

InsightsMindTree Ltd.

-

Intraday fact check

In the last 14 years, only 1.87 % trading sessions saw intraday declines higher than 5 % .

-

Sell Signal: Bears back on track

20 day moving crossover appeared yesterday. Average price decline of -2.6% within 7 days of this signal in last 5 years.

-

Sell Signal: Bears inching ahead

14 day moving crossover appeared yesterday. Average price decline of -2.45% within 7 days of this signal in last 5 years.

Do you find these insights useful?

-

hate it

-

meh

-

love it

Key Metrics

- 55.44

- 84.14

- 76,842.46

- 7

- 18.44

- 0.54

- 10.00

- 0.29

- 4,789.46

- 55.48

- 84.14

- 76,900.12

- 7

- 18.42

- 0.54

- 10.00

- 0.28

- -

Key Metrics

- 55.44

- 84.14

- 0.54

- 4,789.46

- 18.44

- 76,842.46

- 10.00

- 262.18

- 7

- 5,060.00 / 1,348.65

- 0.29

- 4.31

- 55.48

- 84.14

- 0.54

- -

- 18.42

- 76,900.12

- 10.00

- 262.18

- 7

- 5,059.15 / 1,349.25

- 0.28

- 4.31

Returns

- 1 Day -3.45%

- 1 Week -6.5%

- 1 Month 2.87%

- 3 Months 33.26%

- 1 Year 230.32%

- 3 Years 462.78%

- 5 Years 907.8%

- 1 Day -3.42%

- 1 Week -6.22%

- 1 Month 3.02%

- 3 Months 33.38%

- 1 Year 231.15%

- 3 Years 462.73%

- 5 Years 909.86%

MindTree Stock Analysis

Unlock Stock Score, Analyst' Ratings & Recommendations

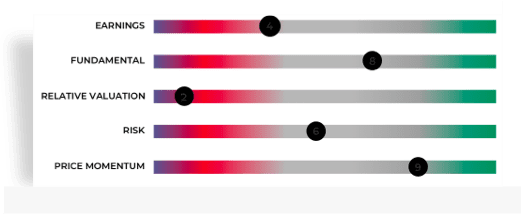

- View Stock Score on a 10-point scale

- See ratings on Earning, Fundamentals, Valuation, Risk & Price

- Check stock performance

START FREE TRIAL

Recommendations

Recent Recos

HOLD

Current

Mean Recos by 35 Analysts

Strong

Sell Sell Hold Buy Strong

Buy

Analyst Trends

| Ratings | Current | 1 Week Ago | 1 Month Ago | 3 Months Ago |

|---|---|---|---|---|

| Strong Buy | 5 | 5 | 5 | 5 |

| Buy | 6 | 6 | 6 | 10 |

| Hold | 11 | 11 | 11 | 9 |

| Sell | 6 | 6 | 5 | 3 |

| Strong Sell | 7 | 7 | 7 | 7 |

| # Analysts | 35 | 35 | 34 | 34 |

Financials

-

Income (P&L)

-

Balance Sheet

-

Cash Flow

-

Ratios

-

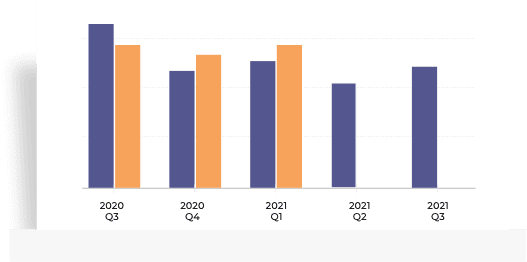

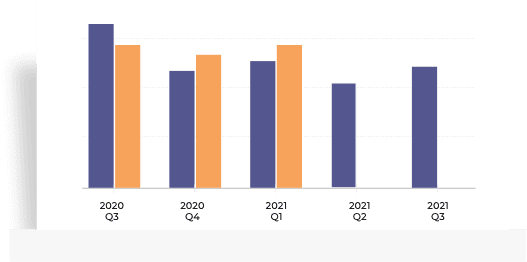

Quarterly | Annual Sep 2021 Jun 2021 Mar 2021 Dec 2020 Sep 2020 Total Income 2,661.00 2,363.50 2,148.20 2,085.30 1,950.50 Total Income Growth (%) 12.59 10.02 3.02 6.91 0.06 Total Expenses 2,116.50 1,885.40 1,718.00 1,627.50 1,592.60 Total Expenses Growth (%) 12.26 9.74 5.56 2.19 -3.27 EBIT 544.50 478.10 430.20 457.80 357.90 EBIT Growth (%) 13.89 11.13 -6.03 27.91 18.16 Profit after Tax (PAT) 398.90 343.40 317.30 326.50 253.70 PAT Growth (%) 16.16 8.23 -2.82 28.70 19.11 EBIT Margin (%) 20.46 20.23 20.03 21.95 18.35 Net Profit Margin (%) 14.99 14.53 14.77 15.66 13.01 Basic EPS (₹) 24.21 20.85 19.26 19.82 15.41 Quarterly | Annual Sep 2021 Jun 2021 Mar 2021 Dec 2020 Sep 2020 Total Income 2,660.90 2,363.50 2,148.20 2,085.30 1,950.50 Total Income Growth (%) 12.58 10.02 3.02 6.91 0.06 Total Expenses 2,116.50 1,885.30 1,718.20 1,627.50 1,592.60 Total Expenses Growth (%) 12.26 9.73 5.57 2.19 -3.27 EBIT 544.40 478.20 430.00 457.80 357.90 EBIT Growth (%) 13.84 11.21 -6.07 27.91 18.16 Profit after Tax (PAT) 398.80 343.50 317.10 326.50 253.70 PAT Growth (%) 16.10 8.33 -2.88 28.70 19.11 EBIT Margin (%) 20.46 20.23 20.02 21.95 18.35 Net Profit Margin (%) 14.99 14.53 14.76 15.66 13.01 Basic EPS (₹) 24.20 20.86 19.25 19.82 15.41 Quarterly | Annual FY 2021 FY 2020 FY 2019 FY 2018 FY 2017 Total Revenue 8,119.50 7,839.90 7,110.80 5,653.00 5,291.70 Total Revenue Growth (%) 3.57 10.25 25.79 6.83 11.24 Total Expenses 6,621.10 7,011.10 6,124.00 4,910.70 4,736.80 Total Expenses Growth (%) -5.56 14.49 24.71 3.67 17.43 Profit after Tax (PAT) 1,110.50 630.90 754.10 570.10 418.60 PAT Growth (%) 76.02 -16.34 32.28 36.19 -24.24 Operating Profit Margin (%) 19.43 11.35 14.09 13.89 10.96 Net Profit Margin (%) 13.93 8.12 10.73 10.43 7.99 Basic EPS (₹) 67.44 38.35 45.94 34.39 24.93 Quarterly | Annual FY 2021 FY 2020 FY 2019 FY 2018 FY 2017 Total Revenue 8,119.50 7,839.90 7,110.80 5,515.10 5,094.90 Total Revenue Growth (%) 3.57 10.25 28.93 8.25 14.48 Total Expenses 6,621.30 7,011.20 6,124.10 4,720.80 4,510.50 Total Expenses Growth (%) -5.56 14.49 29.73 4.66 22.67 Profit after Tax (PAT) 1,110.30 630.80 754.00 624.90 446.00 PAT Growth (%) 76.01 -16.34 20.66 40.11 -26.27 Operating Profit Margin (%) 19.43 11.35 14.09 15.23 11.97 Net Profit Margin (%) 13.93 8.12 10.73 11.73 8.84 Basic EPS (₹) 67.43 38.35 45.94 37.69 26.56 All figures in Rs Cr, unless mentioned otherwise

-

Annual FY 2021 FY 2020 FY 2019 FY 2018 FY 2017 Total Assets 6,361.40 5,156.60 4,179.00 3,736.50 3,390.60 Total Assets Growth (%) 23.36 23.39 11.84 10.20 3.47 Total Liabilities 2,042.40 1,999.80 872.90 995.10 813.50 Total Liabilities Growth (%) 2.13 129.10 -12.28 22.32 -5.63 Total Equity 4,319.00 3,156.80 3,306.10 2,741.40 2,577.10 Total Equity Growth (%) 36.82 -4.52 20.60 6.38 6.72 Current Ratio (x) 2.87 2.46 3.24 2.54 2.64 Total Debt to Equity (x) 0.00 0.00 0.00 0.11 0.04 Contingent Liabilities 125.50 258.30 376.90 159.60 138.80 Annual FY 2021 FY 2020 FY 2019 FY 2018 FY 2017 Total Assets 6,360.60 5,156.50 4,179.00 3,805.40 3,396.50 Total Assets Growth (%) 23.35 23.39 9.82 12.04 3.66 Total Liabilities 2,042.00 1,999.90 873.00 967.30 776.40 Total Liabilities Growth (%) 2.11 129.08 -9.75 24.59 -9.73 Total Equity 4,318.60 3,156.60 3,306.00 2,838.10 2,620.10 Total Equity Growth (%) 36.81 -4.52 16.49 8.32 8.43 Current Ratio (x) 2.87 2.46 3.23 2.57 2.70 Total Debt to Equity (x) 0.00 0.00 0.00 0.11 0.04 Contingent Liabilities 125.50 158.50 299.70 110.30 288.20 All figures in Rs Cr, unless mentioned otherwise

-

Annual FY 2021 FY 2020 FY 2019 FY 2018 FY 2017 Net Cash flow from Operating Activities 1,996.00 825.10 630.50 564.40 653.50 Net Cash used in Investing Activities -1,183.30 -22.90 -193.30 -200.00 -453.30 Net Cash flow from Financing Activities -422.50 -696.00 -522.10 -287.50 -137.60 Net Cash Flow 368.80 135.00 -71.60 76.70 57.10 Closing Cash & Cash Equivalent 759.70 390.90 255.90 327.50 250.80 Closing Cash & Cash Equivalent Growth (%) 94.35 52.75 -21.86 30.58 29.48 Total Debt/ CFO (x) 0.00 0.00 0.00 0.53 0.15 Annual FY 2021 FY 2020 FY 2019 FY 2018 FY 2017 Net Cash flow from Operating Activities 1,995.30 825.20 630.40 606.90 652.90 Net Cash used in Investing Activities -1,183.30 -22.90 -193.30 -246.70 -452.00 Net Cash flow from Financing Activities -422.50 -696.00 -522.10 -283.80 -139.90 Net Cash Flow 368.10 135.00 -71.80 76.10 93.90 Closing Cash & Cash Equivalent 757.50 389.40 254.40 322.90 246.80 Closing Cash & Cash Equivalent Growth (%) 94.53 53.07 -21.21 30.83 28.27 Total Debt/ CFO (x) 0.00 0.00 0.00 0.50 0.15 All figures in Rs Cr, unless mentioned otherwise

-

Annual FY 2021 FY 2020 FY 2019 FY 2018 FY 2017 Return on Equity (%) 25.71 19.98 22.80 20.79 16.24 Return on Capital Employed (%) 32.47 23.00 29.77 27.59 22.00 Return on Assets (%) 17.45 12.23 18.04 15.25 12.34 Interest Coverage Ratio (x) 30.73 16.67 341.28 44.92 30.05 Asset Turnover Ratio (x) 125.25 150.57 168.01 146.20 154.43 Price to Earnings (x) 30.96 21.65 20.58 22.27 18.18 Price to Book (x) 7.95 4.32 4.69 4.63 2.95 EV/EBITDA (x) 18.56 11.28 13.21 13.60 9.80 EBITDA Margin (%) 22.69 14.90 16.43 17.03 14.50 Annual FY 2021 FY 2020 FY 2019 FY 2018 FY 2017 Return on Equity (%) 25.70 19.98 22.80 22.01 17.02 Return on Capital Employed (%) 32.47 23.00 29.77 28.49 22.79 Return on Assets (%) 17.45 12.23 18.04 16.42 13.13 Interest Coverage Ratio (x) 30.73 16.67 341.24 48.28 31.60 Asset Turnover Ratio (x) 125.26 150.57 168.01 139.93 148.37 Price to Earnings (x) 30.96 21.65 20.58 20.33 17.06 Price to Book (x) 7.95 4.32 4.69 4.47 2.90 EV/EBITDA (x) 18.57 11.28 13.21 13.10 9.63 EBITDA Margin (%) 22.69 14.90 16.43 18.14 15.35

Financial InsightsMindTree Ltd.

Do you find these insights useful?

-

hate it

-

meh

-

love it

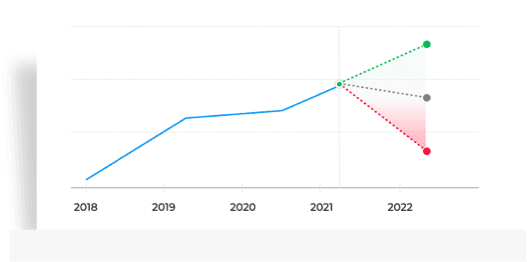

Forecast

-

PRICE

-

REVENUE

-

EARNINGS

-

Get multiple analysts' prediction on MindTree

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

START FREE TRIAL

-

Get multiple analysts' prediction on MindTree

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

START FREE TRIAL

-

Get multiple analysts' prediction on MindTree

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

START FREE TRIAL

Technicals

-

Buy / Sell Signals

-

Price Analysis

-

Pivot Levels & ATR

-

Chart

-

Bullish / Bearish signals for MindTree Ltd. basis selected technical indicators and moving average crossovers.

14 Day EMA Crossover

Bearish signal on daily chart

Appeared on: 24 Nov 2021

14D EMA: 4788.19

Last 4 Sell Signals : 22 Nov 2021

Average price decline of -2.45% within 7 days of Bearish signal in last 5 years

20 Day EMA Crossover

Bearish signal on daily chart

Appeared on: 24 Nov 2021

20D EMA: 4746.24

Last 4 Sell Signals : 12 Jul 2021

Average price decline of -2.60% within 7 days of Bearish signal in last 5 years

-

47%

Positive Movement since

1st Jan 2005 on basis53%

Negative Movement since

1st Jan 2005 on basisExclude

-

Pivot Levels

R1 R2 R3 PIVOT S1 S2 S3 Classic 4823.75 4982.90 5238.40 4727.40 4568.25 4471.90 4216.40 Average True Range

5 DAYS 14 DAYS 28 DAYS ATR 201.89 188.33 177.17

Peer Comparison

-

Stock Performance

-

Ratio Performance

-

- CHART

- TABLE

- 1D

- 1W

- 1M

- 3M

- 6M

- 1Y

- 5Y

NAME 1D 1W 1M 3M 1Y 3Y 5Y MindTree -3.45 -6.50 2.87 33.26 230.32 462.78 907.80 L&T Infotech -2.57 -8.76 3.14 35.46 102.31 337.62 1015.18 Mphasis -2.39 -6.70 -1.31 14.76 140.63 246.60 529.46 L&T Tech -1.56 -6.73 15.64 38.44 212.83 250.43 537.72 Tata Elxsi -0.43 -8.84 -0.33 26.68 284.76 506.07 938.39 Add More All values in %

Choose from Peers

- Oracle

- Coforge

- Persistent System

- Happiest Minds

- KPIT Tech

-

Ratio Performance

NAME P/E (x) P/B (x) ROE % ROCE % ROA % Rev CAGR [3Yr] OPM NPM Basic EPS Current Ratio Total Debt/ Equity (x) Total Debt/ CFO (x) MindTree 55.44 17.79 25.71 32.47 17.45 12.69 19.43 13.93 67.44 2.87 0.00 0.00 L&T Infotech 55.99 16.18 26.50 33.02 18.07 17.62 21.56 15.66 110.98 3.09 0.01 0.02 Mphasis 45.45 9.22 18.64 23.34 12.94 13.54 17.42 12.51 65.18 2.40 0.08 0.35 L&T Tech 67.34 15.98 19.09 23.72 13.07 12.32 17.30 12.23 63.32 3.19 0.00 0.00 Tata Elxsi 81.56 132.11 35.99 52.72 21.91 9.19 18.26 12.01 32.76 1.92 0.00 0.00 Add More Annual Ratios (%)

Choose from Peers

- Oracle

- Coforge

- Persistent System

- Happiest Minds

- KPIT Tech

See All Parameters

Peers InsightsMindTree Ltd.

Do you find these insights useful?

-

hate it

-

meh

-

love it

MF Ownership

-

-

754.44

Amount Invested (in Cr.)

-

3.12%

% of AUM

-

-1.33

% Change (MoM basis)

-

-

-

514.97

Amount Invested (in Cr.)

-

3.22%

% of AUM

-

-10.88

% Change (MoM basis)

-

-

-

276.79

Amount Invested (in Cr.)

-

4%

% of AUM

-

-6.16

% Change (MoM basis)

-

MF Ownership as on 31 October 2021

Top Searches:

F&O Quote

-

Futures

-

Options

-

- Expiry

Price

4,666.00 -170.55 (-3.53%)

Open Interest

15,74,800 2,38,600 (15.15%)

Open High Low Prev Close Contracts Traded Turnover (₹ Lakhs) 4,870.35 4,889.00 4,642.05 4,836.55 4,116 39,372.12 Open Interest as of 24 Nov 2021

Corporate Actions

-

Board Meeting/AGM

-

Dividends

- Others

-

Meeting Date Announced on Purpose Details Oct 13, 2021 Oct 04, 2021 Board Meeting Quarterly Results & Interim Dividend Jul 13, 2021 Jul 02, 2021 Board Meeting Quarterly Results Jul 13, 2021 Jun 14, 2021 AGM Book closure from 7 Jul, 2021 to 13 Jul, 2021 Jul 13, 2021 Apr 16, 2021 AGM - May 24, 2021 Apr 22, 2021 POM - -

Type Dividend Dividend per Share Ex-Dividend Date Announced on Interim 100% 10.0 Oct 21, 2021 Oct 13, 2021 Final 175% 17.5 Jul 05, 2021 Apr 16, 2021 Interim 75% 7.5 Oct 26, 2020 Oct 15, 2020 Final 100% 10.0 Jul 06, 2020 Jun 09, 2020 Interim 30% 3.0 Oct 24, 2019 Oct 09, 2019 -

All Types Ex-Date Record Date Announced on Details Bonus Mar 09, 2016 Mar 10, 2016 Jan 18, 2016 Bonus Ratio: 1 share(s) for every 1 shares held Bonus Jun 03, 2014 Jun 04, 2014 Apr 16, 2014 Bonus Ratio: 1 share(s) for every 1 shares held

About MindTree

MindTree Ltd., incorporated in the year 1999, is a Mid Cap company (having a market cap of Rs 76,842.46 Crore) operating in IT Software sector. MindTree Ltd. key Products/Revenue Segments include Software Development Charges for the year ending 31-Mar-2021. For the quarter ended 30-09-2021, the company has reported a Consolidated Total Income of Rs 2,661.00 Crore, up 12.59 % from last quarter Total Income of Rs 2,363.50 Crore and up 36.43 % from last year same quarter Total Income of Rs 1,950.50 Crore. Company has reported net profit after tax of Rs 398.90 Crore in latest quarter. The company's top management includes Mr.Anilkumar Manibhai Naik, Mrs.Deepa Gopalan Wadhwa, Ms.Apurva Purohit, Mr.Prasanna Rangacharya Mysore, Mr.Bijou Kurien, Mr.Akshaya Bhargava, Mr.Ramamurthi Shankar Raman, Mr.Venugopal Lambu, Mr.Dayapatra Nevatia, Mr.Debashis Chatterjee, Mr.Sekharipuram Narayanan Subrahmanyan, Mr.Chandrasekaran Ramakrishnan. Company has Deloitte Haskins & Sells as its auditors. As on 30-06-2021, the company has a total of 16.47 Crore shares outstanding. Show More

-

Executives

-

Auditors

-

AM

Anilkumar Manibhai Naik

Non Executive Chairman

SN

Sekharipuram Narayanan Subrahmanyan

Non Executive Vice Chairman

DC

Debashis Chatterjee

Managing Director & CEO

DN

Dayapatra Nevatia

COO & Executive Director

RS

Ramamurthi Shankar Raman

Non Executive Director

AB

Akshaya Bhargava

Independent Director

AP

Apurva Purohit

Independent Director

BK

Bijou Kurien

Independent Director

CR

Chandrasekaran Ramakrishnan

Independent Director

DG

Deepa Gopalan Wadhwa

Independent Director

PR

Prasanna Rangacharya Mysore

Independent Director

VL

Venugopal Lambu

Executive Director & President

VA

Vinit Ajit Teredesai

Chief Financial Officer

SS

Subhodh Shetty

Co. Secretary & Compl. Officer

Show More

Key Indices Listed on

Nifty IT, Nifty Midcap 50, Nifty Midcap 100, + 25 more

Address

Global Village,RVCE Post,Mysore Road,Bengaluru, Karnataka - 560059

More Details

MindTree Share Price Update

MindTree Ltd. share price moved down by -3.45% from its previous close of Rs 4,831.10. MindTree Ltd. stock last traded price is 4,664.60

MindTree Ltd. share price moved down by -3.42% from its previous close of Rs 4,833.50. MindTree Ltd. stock last traded price is 4,668.10

| Share Price | Value |

|---|---|

| Today/Current/Last | 4,664.60 4,668.10 |

| Previous Day | 4,831.10 4,833.50 |

Trending in Markets

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an "as-is, as- available" basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.

Ng Stock Price Today What Do Analysts Say

Source: https://economictimes.indiatimes.com/mindtree-ltd/stocks/companyid-15673.cms

0 Response to "Ng Stock Price Today What Do Analysts Say"

Post a Comment